This Week: JPY, GBPUSD, USDInd and Nvidia in focus

- Japan trade gap steers exports and supports yen

- UK CPI guides BoE stance and shapes sterling path

- FOMC Minutes steer USD while gauging easing bias

- US shutdown ends; data returns but gaps persist

- Nvidia earnings add risk as policy reads stay thin

For JPY, the focus is on Japan’s trade balance and its implications for export momentum and yen stability. For GBPUSD, UK inflation will drive BoE expectations and near-term sterling direction. For USDInd, the FOMC Minutes are key as markets gauge how the Fed is leaning toward easing.

Also note: the U.S. shutdown is over, normal data releases resume, and Nvidia earnings add sentiment risk, though October’s CPI and jobs data may never be released, leaving policymakers with an unusual information gap.

Events Watchlist:

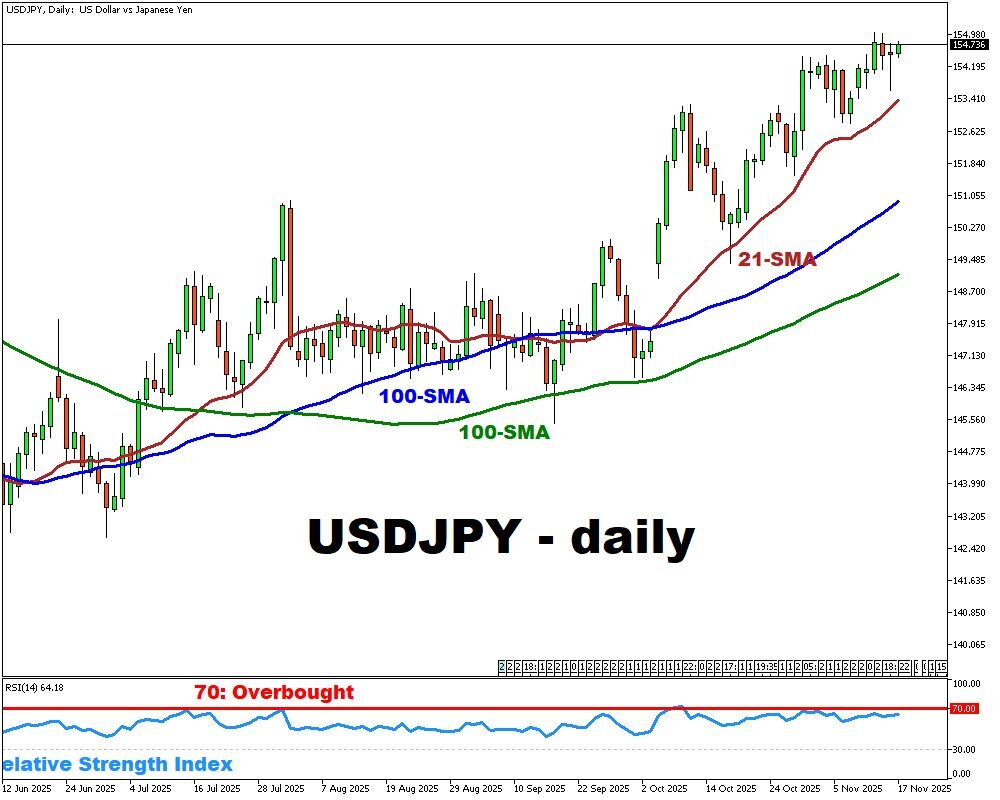

Tuesday, Nov 18: Japan Balance of Trade – JPY (USDJPY)

Japan is running a moderate trade deficit as exports continue to recover while import values remain elevated. A narrower-than-expected deficit would signal firmer external demand and could offer support to the yen. Conversely, a wider deficit would underscore Japan’s dependence on imports and may keep upward pressure on USD/JPY.

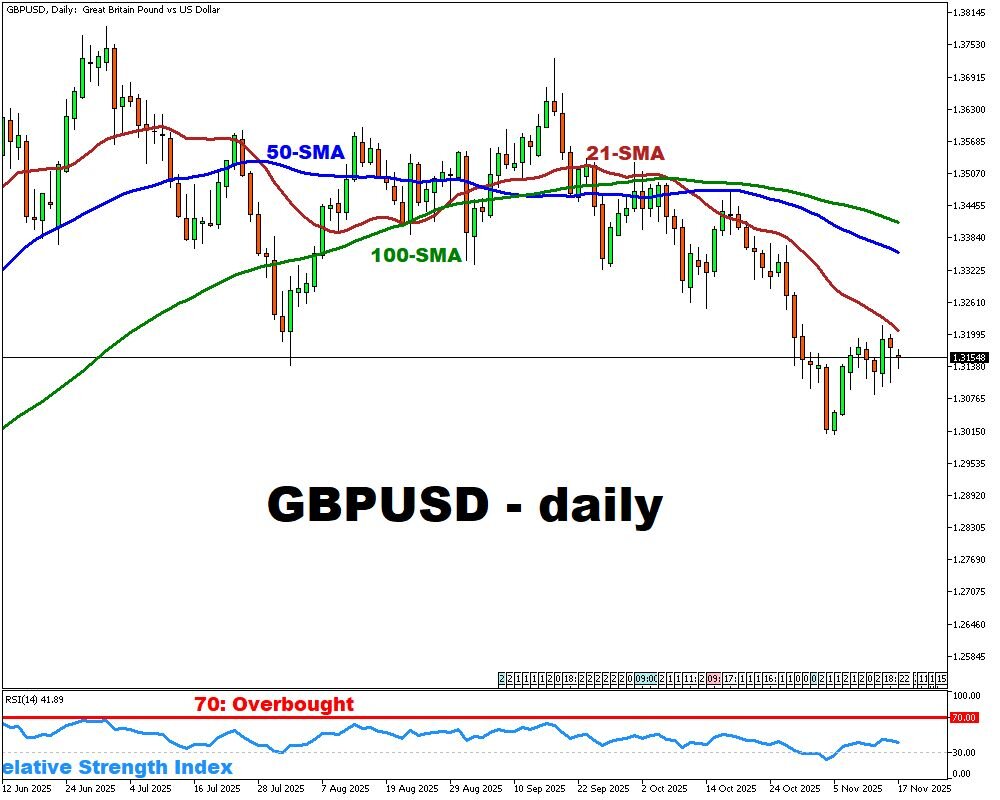

Wednesday, Nov 19: UK Inflation Rate – GBPUSD

UK CPI remains well above target despite recent moderation. Markets expect another reading close to current levels, with services inflation still key. A stronger print could delay BoE easing expectations and support GBPUSD, while a softer reading may strengthen the disinflation trend and weigh on sterling.

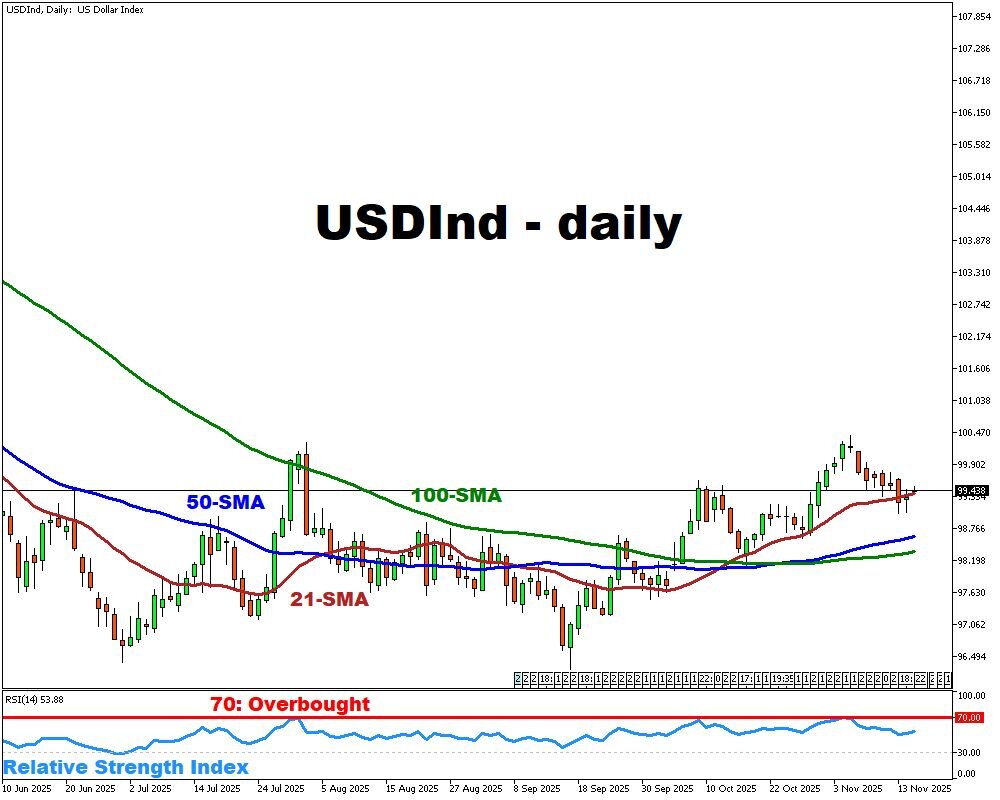

Wednesday, Nov 19: FOMC Minutes – USDInd

The Minutes will detail how policymakers viewed growth and inflation risks at the last meeting. With Nvidia earnings also shaping risk appetite, the tone matters even more: a hawkish bias could back U.S. bond yields and lift USDInd, while a dovish lean may tilt the USD Index lower, especially with October’s missing CPI and jobs data leaving the Fed with a thinner read on the economy.

Other major events this week:

Monday, Nov 17

- CHF: Swiss GDP (Q3)

- CAD: Canada Inflation Rate (Oct)

- USD: NY Empire State Manufacturing Index (Nov)

Tuesday, Nov 18

AUD: RBA Meeting Minutes

- CHF: Swiss Industrial Production (Q3)

- USD: US ADP Employment Change (Weekly); Industrial Production (Sep, Oct); Export Prices (Sep, Oct); Import Prices (Sep, Oct)

- JPY: Japan Balance of Trade (Oct); Machinery Orders (Sep)

- WTI: API Crude Oil Stock Change (w/e Nov 14)

Wednesday, Nov 19

- GBP: UK Inflation Rate (Oct)

- US500: FOMC Minutes; US Building Permits (Sep, Oct); Housing Starts (Sep, Oct)

- Major Earnings: Nvidia (after markets close)

Thursday, Nov 20

- GER40: Germany PPI (Oct)

- CHF: Swiss Balance of Trade (Oct)

- EUR: ECB General Council Meeting; EZ Consumer Confidence (Nov)

- GBP: UK CBI Industrial Trends Orders (Nov)

- USD: US Existing Home Sales (Oct); Fed Goolsbee Speech; Initial Jobless Claims (w/e Nov 15)

- NZD: New Zealand Balance of Trade (Oct)

- AUD: Australia S&P Global Manufacturing and Services PMIs (Oct)

- JPY: Japan Inflation Rate (Oct)

Friday, Nov 21

- GBP: UK Retail Sales (Oct); S&P Global Manufacturing and Services PMIs (Nov); GfK Consumer Confidence (Nov)

- JPY: Japan S&P Global Manufacturing and Services PMIs (Nov)

- FRA30: France HCOB Composite, Manufacturing and Services PMIs (Nov); Business Confidence (Nov)

- GER40: Germany HCOB Manufacturing, Composite and Services PMIs (Nov)

- EUR: Eurozone HCOB Composite, Manufacturing and Services PMIs (Nov); Negotiated Wage Growth (Q3)

- CAD: Canada Retail Sales (Oct)

- USD: US S&P Global Composite, Manufacturing and Services PMIs (Nov)